PSD2 Checklist

10 things to consider when selecting a (new) PSD2 API solution provider.

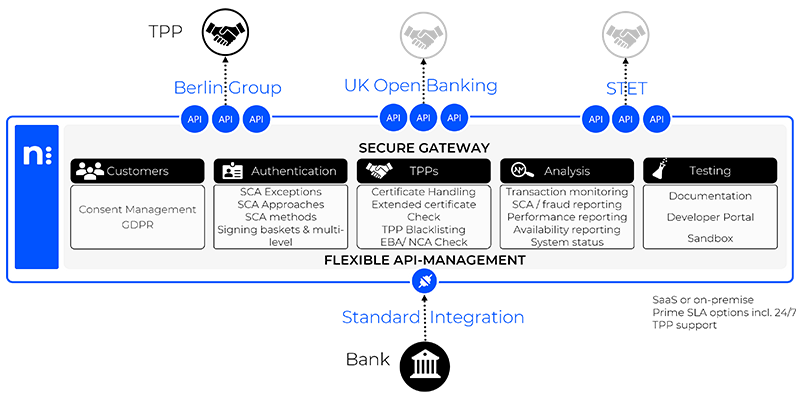

Working with an external PSD2 API solution provider can have various benefits: reducing costs and risks on the one hand and opening new business opportunities through enabling new business models or external service offerings by TPPs on the other hand.

The selection process, however, is complex and cumbersome as a lot of aspects must be taken into consideration. For that reason, ndgit, being one of the leading providers of PSD2 technology and solutions, has put together a set of questions based on the experience of many PSD2 implementation projects with banks all over Europe.

Our checklist is meant to help you structure the decision-making process.