Post

Embedded Lending – Selling high-value goods online

By Oliver Dlugosch, 27. October 2023

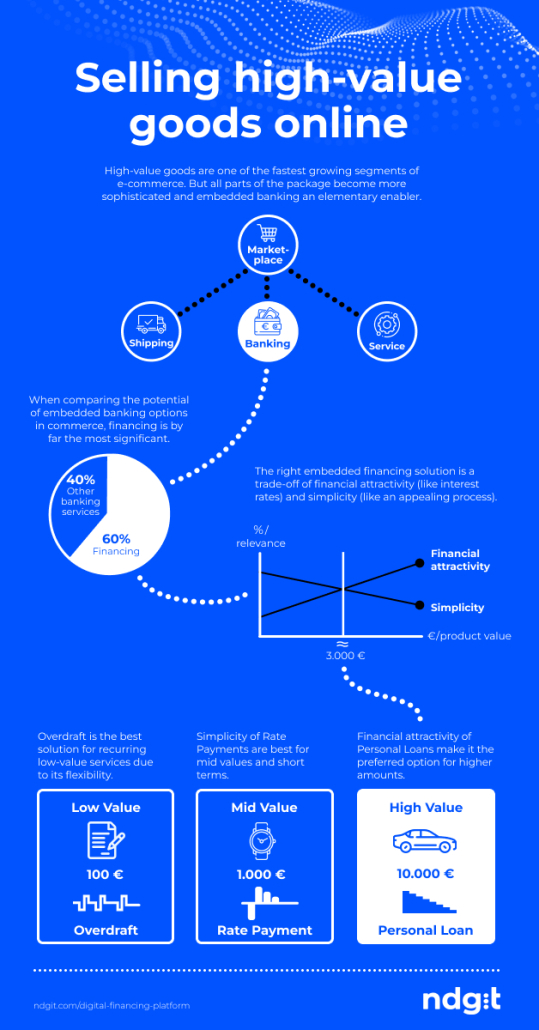

The e-commerce market is booming and the segment of high-value goods such as cars, furniture or electronics in particular is currently growing rapidly. But many consumers cannot afford to simply pay cash for products in the price range of 5,000 to 50,000 euros. They are looking for a suitable payment option that can also be carried out quickly and easily online for more expensive products. Their solution is called embedded lending. A new segment of embedded lending companies is making it easier for non-banks to access financing services. Their offering creates value by driving customer engagement and increasing product sales for the online retailer. As a result, analysts expect new embedded lending providers to be worth $1 trillion by 2030 in the personal loan segment alone.

With higher product values, digital lending becomes the most important payment option for products and services with a value of over EUR 500 onwards. For example, when it comes to buying a car, 18% of buyers said they would prefer to make their purchase online if it meant they could acquire the vehicle more quickly. In 2023, 22% of respondents to a study on online car sales already said they had purchased a vehicle online. This is a percentage increase of 144% compared to the data collected in 2020. (Source: Online Car Sales Sudie 2023 by MHP) This means that the purchase of high-priced goods is becoming the new standard in e-commerce and embedded lending is an increasingly popular payment method.

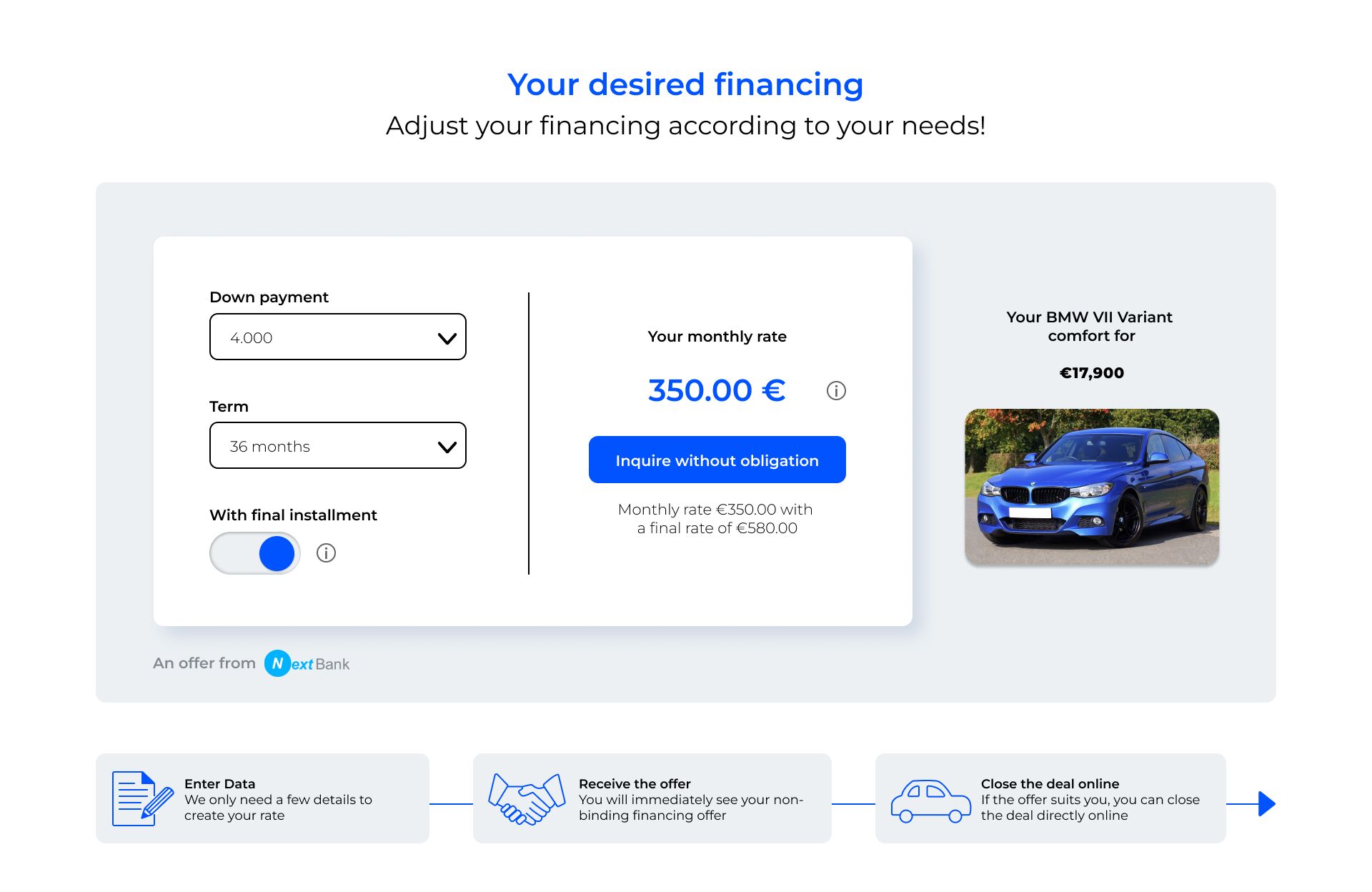

Online financing gives consumers the opportunity to apply for credit directly in the retailer’s checkout. The credit functions are fully integrated into the retailer’s user journey. For the customer, this means that they receive their financing where they need it – at the retailer of their choice. To this end, the financial services partner or bank is simply connected in the backend via program interfaces, also known as APIs (Application Programming Interfaces). New fintechs specializing in embedded lending are filling this need with comprehensive and secure solutions that connect the digital provider and the bank’s credit systems. For merchants, this means they can offer financing solutions themselves without having to invest in sophisticated tech stacks, complex credit processes, or deep knowledge of financing products.

Higher product and financing volumes are changing customers’ requirements for the most suitable credit solution. In the process, the importance of low interest rates, long-term repayment plans, and trust in financial partners are increasing. New embedded finance providers are now addressing this very challenge by packaging credit products into new attractive online user journeys that match the simplicity of Payments to achieve high customer satisfaction and conversion rates.

So how can personal loans best be embedded in the digital purchasing process? First, the entire process – loan application, review, approval, closing, and repayment – should be done online and, of course, without media disruption, so that users can get their loan in just a few clicks.

In addition, fintech innovations such as account analytics or digital signatures offer an optimized customer journey. Thus, digital lending enables consumers to finance high-priced products directly in the online marketplace they trust.

Embedded lending is the answer to the question of how to successfully sell high-priced goods online.